This plan is designed for freelancers who file a Schedule C IRS form to report their income as sole proprietor. There are six different versions of QuickBooks, including QuickBooks Online, QuickBooks Self-Employed, QuickBooks Pro Plus, QuickBooks Premier Plus, QuickBooks Enterprise, and QuickBooks Mac https://www.business-accounting.net/what-is-amortization/ Plus. If a specific version of QuickBooks stood out to you, we recommend taking the software for a test run to make sure you love using it. If you want a happy medium, QuickBooks Mac Plus might be a good balance since its UI is easier to use without sacrificing advanced and customizable features.

What’s the difference between QuickBooks and QuickBooks Online?

You will get priority support through chat and phone, with shorter wait times than non-Priority Circle members. QuickBooks Solopreneur works very well for one-person businesses, especially those with a limited client base and minimal expenses and income streams. The program provides features, such as invoicing, expense tracking, and mileage tracking that can help users effectively manage business finances. For the latest information on pricing and promotions, visit our pricing page. If you work with an accounting professional, you may want to speak with your accountant or bookkeeper prior to signing up for any possible discounts or packages.

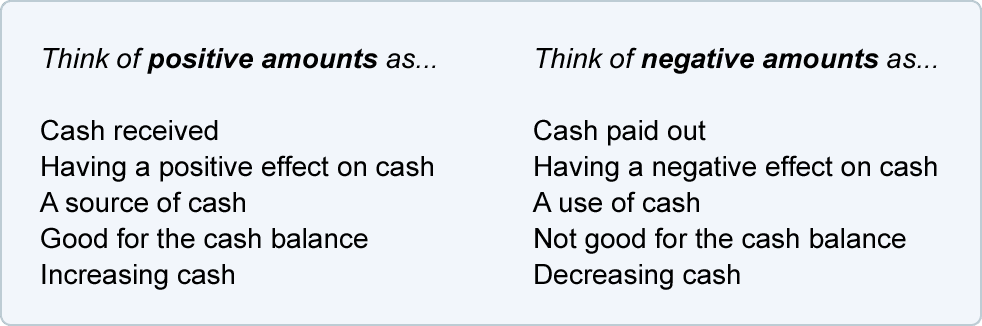

Talk to our sales team

Batch expensing allows you to record and categorize multiple expenses at once instead of entering them individually. This is especially useful if you have many expenses to record, such as business travel expenses, office supplies, and equipment purchases. You can upload expense receipts in bulk, categorize them according to the appropriate expense account, and then submit them for approval. Plus allows you to assign classes and locations to your transactions, so you can see how your business performs across divisions, locations, rep areas, or any units that are relevant to your business. If you run businesses in multiple locations and you want to see which one is most profitable, an upgrade to Plus from Essentials is worth the price. With Essentials, you can track your unpaid bills easily and pay them directly within QuickBooks.

Can I switch from QuickBooks Solopreneur to any higher version of QuickBooks Online?

- If you work with an accounting professional, you may want to speak with your accountant or bookkeeper prior to signing up for any possible discounts or packages.

- These can be useful for companies with more complex business structures and accounting workflows.

- The biggest difference between Simple Start and Essentials is that Simple Start doesn’t allow you to pay and manage bills.

- Users can also add a Salesforce CRM connector for $150/month and QuickBooks Time Elite for $5/employee each month.

- Unlike QuickBooks, customer support is only offered through an online messaging system, though the company will call customers in response to support submissions if necessary.

- From here, you can name the price rule and select a start and end date (if the promotion is only for a limited time).

But other accounting tools come with slightly different strengths, so read our complete guide to the best small business accounting software to see if another option is best for your unique needs. QuickBooks Online pricing how to calculate overhead allocation offers five main plans, plus a host of add-ons for an extra monthly charge. QuickBooks Online is better than QuickBooks Desktop if your business is looking for easy cloud-based accounting software with more mobility.

QuickBooks Online resources

Along with most types of software, the best invoicing software programs offer many levels of security. QuickBooks invoicing is part of the company’s subscription service and the pricing can be found online. QuickBooks does offer a free invoice generator tool where you can easily download templates for Microsoft Word, Microsoft Excel and PDF. Platforms, such as Zoho Invoice, Square Invoices and PayPal Invoicing, won’t necessarily have all of the tools that come with an Intuit QuickBooks subscription. However, they will allow you to easily create an invoice and keep track of your accounting for free. QuickBooks invoices are optimized for mobile, which means customers will be able to view them properly if they are on their mobile device.

It isn’t offered in QuickBooks Essentials, QuickBooks Simple Start or QuickBooks Self-Employed. Stacy Kildal is owner and operator of Kildal Services LLC, an accounting and technology consulting company that specializes in QuickBooks. From 2012 to 2017, she has been named one of CPA Practice Advisor’s Most Powerful Women In Accounting. She is a big fan of working mobile and has been recognized by Intuit as being an expert on QuickBooks Online, having written Intuit’s original courses for the U.S., Singapore and Canadian versions.

You can also create a price rule by navigating to the Products and Services list and then selecting the drop-down arrow next to the “More” tab. Alternatively, QuickBooks price levels can also be accessed from the “edit item record” function. While it says “Beta” next to price rules, you don’t need to be concerned — the price levels function works great as-is. It is worth noting though, that price rules — or price levels, don’t impact reporting. In other words, you can’t run a report specifically on sales affected by QuickBooks price levels. When working with QuickBooks Online Plus or Advanced, you have the option to create price levels.

However, as QuickBooks Desktop is locally installed, you’ll be responsible for your own data security. The custom price varies depending on the size of your business but should be somewhere between $200 and $600 per month. The QuickBooks Payroll software tracks employees by name, pay rate, pay method, and current status. The Essentials plan is a great fit for growing small businesses that have an increased number of suppliers, employees, and clients. Finally, you can start creating budgets and cash flow projections based on your client and supplier information.

If you need more users than you can get with QuickBooks Premier but don’t need advanced features, then maybe Gold is a better option. One of the biggest differences between QuickBooks Pro and QuickBooks Premier is that Quickbooks Premier offers six industry-specific versions of the software in addition to the standard version. These industry editions add customized features and reports to fit your business needs better.

QuickBooks Online made it to our Best Accounting Software for Small Business list because it is a comprehensive platform that checks all the boxes for accounting, invoicing and expense tracking. If you aren’t sure about the product, you can give it a 30-day test run with 100% capabilities of the Simple Start Plan to see if it meets your needs. Sign up for QuickBooks Online today or start your free 30-day trial to begin using powerful cost tracking software.

QuickBooks Self-Employed offers basic features at a cost-effective price. However, businesses that require multiple users or want more accounting features will benefit more from using QuickBooks Online. QuickBooks Online is cloud-based software, so it offers more mobility. But what QuickBooks Pro Plus sacrifices in mobility, https://www.simple-accounting.org/ it more than makes up for in its features, which are more developed than what you’ll find in QuickBooks Online. However, QuickBooks Pro’s features do come at a price, as this software has a steep learning curve. If you’re new to accounting software, it’s important that you have the time to commit to learning the software.